Overview

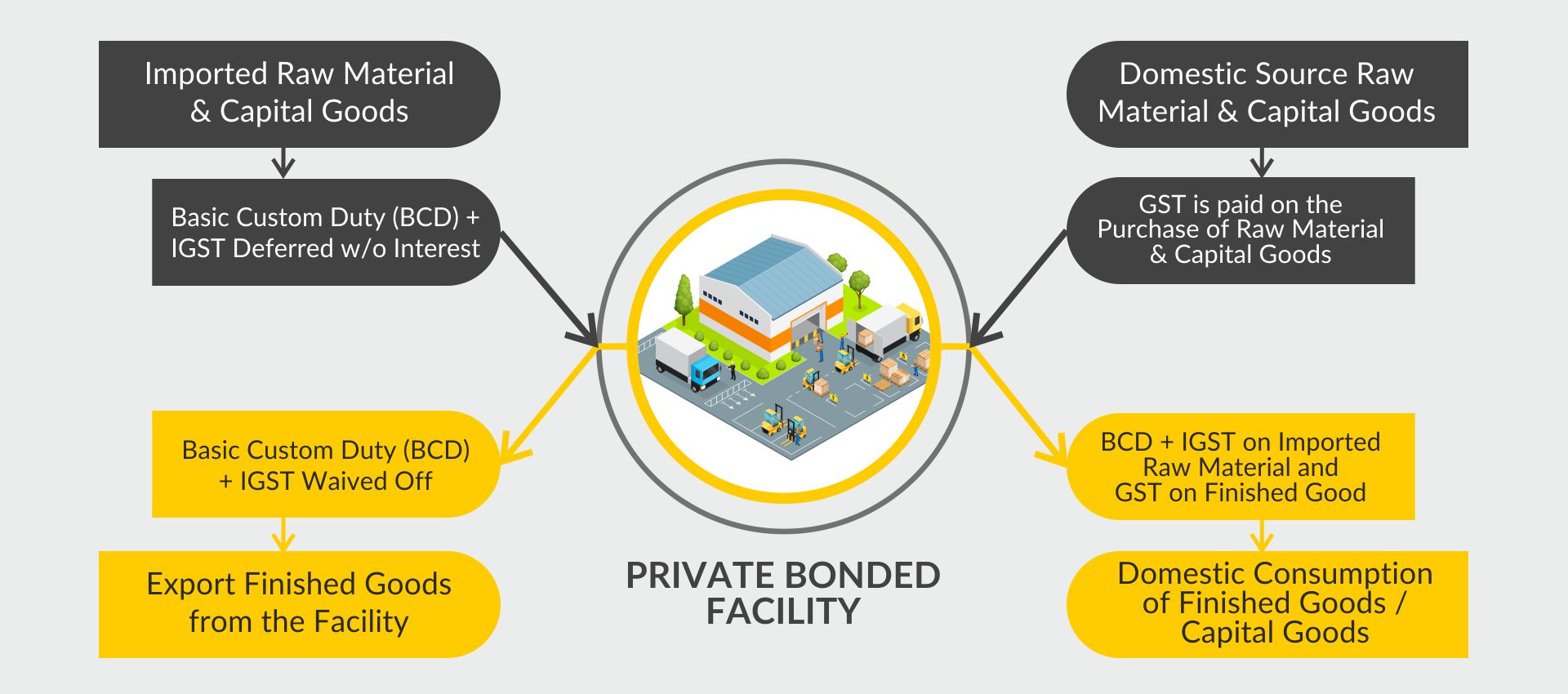

India allows manufacturing and other operations in a bonded manufacturing facility to promote India as the manufacturing hub globally and the commitment towards ease of doing business, under Section 65 of the Customs Act, 1962 (hereinafter referred to as, “the Customs Act”) provides for manufacturing as well as carrying out other operations in a bonded warehouse. The Board has prescribed “Manufacture and Other Operations (MOOWR)”.

Central Board of Indirect Taxes (CBIC) is allowing import of raw materials and capital goods without payment of duty for manufacturing and other operations in a bonded manufacturing facility.

Most promising feature of the scheme is that unlike various existing schemes, the MOOWR scheme is delinked to the quantum / obligation of exports and the benefit is also extended to the importers who import the goods for domestic clearance / sell.

Advantage of the scheme

Deferred Duty On Capital Goods

Duty of Capital goods used in Manufacturing or other operations is deferred Until their clearance from the bonded facility.

Capital Goods can be Exported and duties can be avoided

Deferred Duty On Import of Raw Material

Duty on Import of Raw Material used in Manufacturing or other operations is deferred Until their clearance of Finished Goods.

Deferred duties will be waived in case Finished goods is exported

Seamless Warehouse to Warehouse Transfer

Transfer of goods from Bonded Facility to another bonded facility without payment of Duty

No Export Obligation

No Limit on the share of Clearance of goods for the Domestic Market. An Entity may manufacture in Bonded Warehouse and sale 100% in Domestic Market.

Clearance of Warehouse Goods

Ease of Bonded Manufacturing

FAQ

Who is eligible for applying for manufacture and other operations in a bonded warehouse?

The following persons are eligible to apply for manufacture and other operations in a bonded warehouse,

- A person who has been granted a licence for a warehouse under Section 58 of the Customs Act, in accordance with Private Warehouse Licensing Regulations, 2016.

- A person can also make a combined application for licence for a warehouse under Section 58, along with permission for undertaking manufacturing or other operations in the warehouse under Section 65 of the Act. The persons mentioned have to be a citizen of India or an entity incorporated or registered in India.

Can a factory which is solely into manufacturing goods, which are to be sold in the domestic market, eligible for applying for manufacture and other operations in a bonded warehouse?

The eligibility of a factory for manufacture and other operations in a bonded warehouse does not depend upon whether the final goods will be sold in the domestic market or exported. There is no quantitative restriction on sale of finished goods in the domestic market. Any factory can avail a license under Section 58 of the Customs Act along with a permission under Section 65 if they intend to import goods without upfront payment of Customs duty at point of import and deposit them in the warehouse, either as capital goods or as inputs for further processing.

Can a unit undertaking manufacture and other operations in a bonded warehouse import inputs without payment of duty? If yes, whether only BCD or both BCD and IGST on imports is covered? For how long is duty deferment available? Is interest payable after some time?

Manufacture and other operations in a bonded warehouse is a duty deferment scheme. Thus, both BCD and IGST on imports stand deferred. In the case of goods other than capital goods, the import duties (both BCD and IGST) stand deferred till they are cleared from the warehouse for home consumption, and no interest is payable on duty. In case the finished goods are exported, the duty on the imported inputs (both BCD and IGST) stands remitted i.e. they will not be payable. The duty deferment is without any time limitation.

Is import of raw material without BCD and IGST allowed? Will there be any interest obligation if IGST is paid when finished goods are sold in domestic markets?

Inputs/raw materials can be imported and deposited in the licensed warehouse without payment of BCD and IGST. No interest liability arises when the duties are paid at the time of ex-bonding the resultant goods. The duties (without any interest) are to be paid only when the resultant goods are being cleared for home consumption.

Source: IceGate, Invest India etc.

Who is eligible for applying for manufacture and other operations in a bonded warehouse?

The following persons are eligible to apply for manufacture and other operations in a bonded warehouse,

- A person who has been granted a licence for a warehouse under Section 58 of the Customs Act, in accordance with Private Warehouse Licensing Regulations, 2016.

- A person can also make a combined application for licence for a warehouse under Section 58, along with permission for undertaking manufacturing or other operations in the warehouse under Section 65 of the Act. The persons mentioned have to be a citizen of India or an entity incorporated or registered in India.

Can a factory which is solely into manufacturing goods, which are to be sold in the domestic market, eligible for applying for manufacture and other operations in a bonded warehouse?

The eligibility of a factory for manufacture and other operations in a bonded warehouse does not depend upon whether the final goods will be sold in the domestic market or exported. There is no quantitative restriction on sale of finished goods in the domestic market. Any factory can avail a license under Section 58 of the Customs Act along with a permission under Section 65 if they intend to import goods without upfront payment of Customs duty at point of import and deposit them in the warehouse, either as capital goods or as inputs for further processing.

Is an existing factory which solely manufactured goods to be sold in the domestic market, eligible for application for manufacture and other operations in a bonded warehouse? How will the existing capital goods and inputs be accounted?

Yes. Any unit in Domestic Tariff Area (DTA)is eligible for making an application for manufacture and other operations in a bonded warehouse i.e. an old factory in DTA is eligible for applying. The accounting form prescribed for the units undertaking manufacture and other operations in a bonded warehouse provides for accounting of DTA receipts. Thus, the existing capital goods and inputs must be accounted in the accounting form prescribed. The form also provides for a remarks column in case certain remarks are to be entered.

Is manufacture and other operations in a bonded warehouse allowed in Public Bonded Warehouse licensed under Section 57 of the Customs Act?

No. At present, manufacture and other operations in a bonded warehouse is allowed only in a Private Bonded Warehouse licensed under Section 58 of the Customs Act.

Will a unit licensed under Section 65 and Section 58 of the Customs Act, 1962, be under the physical control of Customs?

No. There is no physical control of a unit licensed under Section 65 and Section 58 of the Customs Act, 1962, on a day to day basis. The unit will be subject to risk based audits.

Can the license under Section 65 and Section 58 of the Customs Act, 1962, be obtained on bare land with identified boundaries or a built structure is imperative for obtaining the said license?

The regulations do not mandate that a fully enclosed structure is a pre-requisite for grant of license. What is important is that the site or building is suitable for secure storage of goods and discharge of compliances, such as proper boundary walls, gate(s) with access control and personnel to safeguard the premises. Moreover, depending on the nature of goods used, the operations and the industry, some units may operate without fully closed structures. The Principal Commissioner/Commissioners of Customs will take into consideration the nature of premises, the facilities, equipment and personnel put in place for secure storage of goods, while considering grant of license.

Do we need to renew license under Section 58 or permission under Section 65?

The license and permission granted is valid unless it is cancelled or surrendered, or the license issued under Section 58 is cancelled or surrendered. Thus, no renewal of the license under Section 58 or permission under Section 65 is required.

Can a unit undertaking manufacture and other operations in a bonded warehouse import capital goods without payment of duty? If yes, whether only BCD or both BCD and IGST on imports is covered? For how long is duty deferment available? Is interest payable after some time?

A unit licensed under Sections58 and 65 can import capital goods and warehouse them without payment of duty. Manufacture and other operations in a bonded warehouse is a duty deferment scheme. Thus, both BCD and IGST on imports stand deferred. In the case of capital goods, the import duties (both BCD and IGST) stand deferred till they are cleared from the warehouse for home consumption or are exported. The capital goods can be cleared for home consumption as per Section 68 read with Section 61 of the Customs Act on payment of applicable duty without interest. The capital goods can also be exported after use, without payment of duty as per Section 69 of the Customs Act. The duty deferment is without any time limitation.

Would any customs duty be payable on the goods manufactured in the bonded premises using the imported capital goods (on which duty has been deferred) and sold into the domestic tariff area?

The payment of duty on the finished goods is clarified in Paras 8 and 9 of the Circular No. 34/2019. Duty on the capital goods would be payable if the capital goods itself are cleared into the domestic market (home consumption). Thus, the duty on the capital goods does not get incorporated on the finished goods. Thus, no extra duty on finished goods cleared into DTA is payable on account of imported capital goods (on which duty has been deferred).

Can a unit undertaking manufacture and other operations in a bonded warehouse import inputs without payment of duty? If yes, whether only BCD or both BCD and IGST on imports is covered? For how long is duty deferment available? Is interest payable after some time?

Manufacture and other operations in a bonded warehouse is a duty deferment scheme. Thus, both BCD and IGST on imports stand deferred. In the case of goods other than capital goods, the import duties (both BCD and IGST) stand deferred till they are cleared from the warehouse for home consumption, and no interest is payable on duty. In case the finished goods are exported, the duty on the imported inputs (both BCD and IGST) stands remitted i.e. they will not be payable. The duty deferment is without any time limitation.

Is import of raw material without BCD and IGST allowed? Will there be any interest obligation if IGST is paid when finished goods are sold in domestic markets?

Inputs/raw materials can be imported and deposited in the licensed warehouse without payment of BCD and IGST. No interest liability arises when the duties are paid at the time of ex-bonding the resultant goods. The duties (without any interest) are to be paid only when the resultant goods are being cleared for home consumption.

Would it be mandatory to appoint a warehouse keeper in the factory licensed under Section 65 of the Customs Act? Would all goods cleared from the said factory be subject to inspection by the warehouse keeper/ Customs authorities?

A warehouse keeper has to be appointed, for a premise to be licensed as a private warehouse under Section 58 of the Customs Act. The warehouse keeper is expected to discharge duties and responsibilities, maintain accounts and also sign the documents, on behalf of the licensee. The warehouse keeper is expected to supervise and satisfy himself about the veracity of the declaration/ accounts that he is signing. The inspection of goods by customs at the stage of ex-bonding would be done, only if there is indication of risks and not as a matter of routine practice. Approval of the bond officer is not required for clearance of the goods from the warehouse.

How frequently is an audit of a unit operating under Section 65 of Customs Act, 1962 expected?

The audit of units operating under Section 65 would also be based on risk criteria. There is no prescribed frequency for such audit.

What is the customs document/ form for movement of imported goods on which duty has been deferred to/ from a unit undertaking manufacture and other operations in a bonded warehouse? Are such goods required to be under customs escort during their movement?

Following are the customs document for movement of imported goods on which duty has been deferred to/ from a unit undertaking manufacture and other operations in a bonded warehouse:

- Customs Station to Section 65 unit: Bill of entry for warehousing. It is clarified that no separate form is prescribed for movement from Customs station to Section 65 unit as the goods are already accompanied by the Bill of entry for warehousing.

- From another warehouse (non-Section 65) to a Section65 Unit: Form for transfer of goods from a warehouse as prescribed under the Warehoused Goods (Removal) Regulations, 2016. This is because warehouse which is not a Section 65 unit has to follow the Warehoused Goods (Removal) Regulations, 2016.

- From Section 65 Unit to another warehouse (the other warehouse can be a Section 65 unit or a non-Section 65 warehouse): Form prescribed in Manufacture and Other Operations in Warehouse (no. 2) Regulations, 2019.The goods will not be under customs escort during movement. 15.If the imported capital goods are cleared for home consumption after use, is depreciation available? Response: No. Depreciation is not available if imported capital goods (on which duty has been deferred) are cleared for home consumption after use in a Section65 unit.

If the imported capital goods are cleared for export after use, is depreciation available?

The imported capital goods (on which duty has been deferred) after use in a Section 65 unit can be exported without payment of duty as per Section 69 of the Customs Act. For the purposes of valuation of the export goods, the same will be as per the Section 14 of the Customs Act read with the Customs Valuation (Determination of Value of Export Goods) Rules 2007.

Can all export benefits under FTP and Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017(IGCR)be taken in Bonded warehouse simultaneously?

The eligibility to export benefits under FTP or IGCR would depend upon the respective scheme. If the scheme allows, unit operating under Section 65 has no impact on the eligibility. In other words, a unit operating under Section 65 can avail any other benefit, if the benefit scheme allows.

What will be the method of inventory control method in Section65 units? Whether First in First Out (FIFO) method can be followed?

The Generally Accepted Accounting Principles will be followed for inventory control in a Section 65 unit. Thus, FIFO method can be followed.

What is the procedure and documentation requirements for re-entry of manufactured goods, returned by the customers for repair, in the premises?

Once the goods are cleared from the warehouse, they will no longer be treated as warehoused goods. Thus, if the resultant goods cleared from the warehouse are returned by the customer for repair, they will be entered as DTA receipts (this is provided in the accounting form). After repair, when the same is cleared from the warehouse, the same will be entered in the prescribed accounting form. If the goods were exported and subsequently rejected or sent back for repair by the customer, then the goods upon re-import have to be entered as Imports receipts in the accounting form. The relevant customs notification for re-imports has to be followed while filing the Bill of Entry for re-import of the goods.

What is the procedure for surrender of licence for a Section 65 unit?

Since the unit operating under Section 65 is also licensed as a Private Bonded warehouse under Section 58 of the Customs Act, the procedure for surrender of licence will be as per the regulation 8 of the Private Warehouse Licensing Regulations, 2016.A licensee may therefore, surrender the licence granted to him by making a request in writing to the Principal Commissioner of Customs or Commissioner of Customs, as the case may be. On receipt of such request, the licence will be cancelled subject to payment of all dues and clearance of remaining goods in such warehouse.

Who is eligible for applying for manufacture and other operations in a bonded warehouse?

The following persons are eligible to apply for manufacture and other operations in a bonded warehouse –

- A person who has been granted a licence for a warehouse under Section 58 of the Customs Act, in accordance with Private Warehouse Licensing Regulations, 2016.

- A person can also make a combined application for a licence for a warehouse under Section 58, along with permission for undertaking manufacturing or other operations in the warehouse under Section 65 of the Act. The persons mentioned have to be a citizen of India or an entity incorporated or registered in India.

Can a factory which is solely into manufacturing goods, which are to be sold in the domestic market, eligible for applying for manufacture and other operations in a bonded warehouse?

The eligibility of a factory for manufacture and other operations in a bonded warehouse does not depend upon whether the final goods will be sold in the domestic market or exported. There is no quantitative restriction on the sale of finished goods in the domestic market. Any factory can avail a license under Section 58 of the Customs Act along with permission under Section 65 if they intend to import goods without upfront payment of Customs duty at point of import and deposit them in the warehouse, either as capital goods or as inputs for further processing.

Is an existing factory which solely manufactured goods to be sold in the domestic market, eligible for application for manufacture and other operations in a bonded warehouse? How will the existing capital goods and inputs be accounted?

Yes. Any unit in Domestic Tariff Area (DTA) is eligible for making an application for manufacture and other operations in a bonded warehouse i.e. an old factory in DTA is eligible for applying. The accounting form prescribed for the units undertaking manufacture and other operations in a bonded warehouse provides for an accounting of DTA receipts. Thus the existing capital goods and inputs must be accounted in the accounting form prescribed. The form also provides for a remarks column in case certain remarks are to be entered.

Is manufacture and other operations in a bonded warehouse allowed in Public Bonded Warehouse licensed under Section 57 of the Customs Act?

No. At present, manufacture and other operations in a bonded warehouse is allowed only in a Private Bonded Warehouse licensed under Section 58 of the Customs Act.

Will a unit licensed under Section 65 and Section 58 of the Customs Act, 1962, be under the physical control of Customs?

No. There is no physical control of a unit licensed under Section 65 and Section 58 of the Customs Act, 1962, on a day to day basis. The unit will be subject to risk-based audits.

Can the license under Section 65 and Section 58 of the Customs Act, 1962, be obtained on bare land with identified boundaries or a built structure is imperative for obtaining the said license?

The regulations do not mandate that a fully enclosed structure is a prerequisite for grant of license. What is important is that the site or building is suitable for secure storage of goods and discharge of compliances, such as proper boundary walls, gate(s) with access control and personnel to safeguard the premises. Moreover, depending on the nature of goods used, the operations and the industry, some units may operate without fully closed structures. The Principal Commissioner/Commissioners of Customs will take into consideration the nature of premises, the facilities, equipment and personnel put in place for secure storage of goods, while considering grant of license.

Do we need to renew license under Section 58 or permission under Section 65?

The license and permission granted is valid unless it is cancelled or surrendered, or the license issued under Section 58 is cancelled or surrendered. Thus no renewal of the license under Section 58 or permission under Section 65 is required.

Can a unit undertaking manufacture and other operations in a bonded warehouse import capital goods without payment of duty? If yes, whether only BCD or both BCD and IGST on imports is covered? For how long is duty deferment available? Is interest payable after some time?

A unit licensed under Sections 58 and 65 can import capital goods and warehouse them without payment of duty. Manufacture and other operations in a bonded warehouse is a duty deferment scheme. Thus both BCD and IGST on imports stand deferred. In the case of capital goods, the import duties (both BCD and IGST) stand deferred till they are cleared from the warehouse for home consumption or are exported. The capital goods can be cleared for home consumption as per Section 68 read with Section 61 of the Customs Act on payment of applicable duty without interest. The capital goods can also be exported after use, without payment of duty as per Section 69 of the Customs Act. The duty deferment is without any time limitation.

Would any customs duty be payable on the goods manufactured in the bonded premises using the imported capital goods (on which duty has been deferred) and sold into the domestic tariff area?

The payment of duty on the finished goods is clarified in Paras 8 and 9 of the Circular No. 34/2019. Duty on the capital goods would be payable if the capital goods itself are cleared into the domestic market (home consumption). Thus the duty on the capital goods does not get incorporated on the finished goods. Thus no extra duty on finished goods cleared into DTA is payable on account of imported capital goods (on which duty has been deferred). Refer to the Bonded Manufacturing microsite for more details.

Can a unit undertaking manufacture and other operations in a bonded warehouse import inputs without payment of duty? If yes, whether only BCD or both BCD and IGST on imports is covered? For how long is duty deferment available? Is interest payable after some time?

Manufacture and other operations in a bonded warehouse is a duty deferment scheme. Thus both BCD and IGST on imports stand deferred. In the case of goods other than capital goods, the import duties (both BCD and IGST) stand deferred till they are cleared from the warehouse for home consumption, and no interest is payable on duty. In case the finished goods are exported, the duty on the imported inputs (both BCD and IGST) stands remitted i.e. they will not be payable. The duty deferment is without any time limitation.

Refer to the Bonded Manufacturing microsite for more details.

Total Visitors

Total Visitors